India’s e-commerce landscape has evolved dramatically, transforming into a $60 billion powerhouse that’s reshaping how over 270 million Indians shop online. As we navigate through 2025, four major platforms are battling for market dominance: Meesho, Amazon India, Flipkart, and Myntra. But which one is experiencing the fastest growth and offers the best prospects for businesses?

The Current Market Landscape: A $60 Billion Opportunity

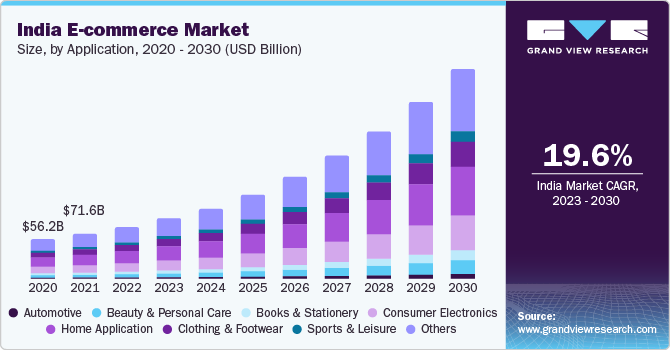

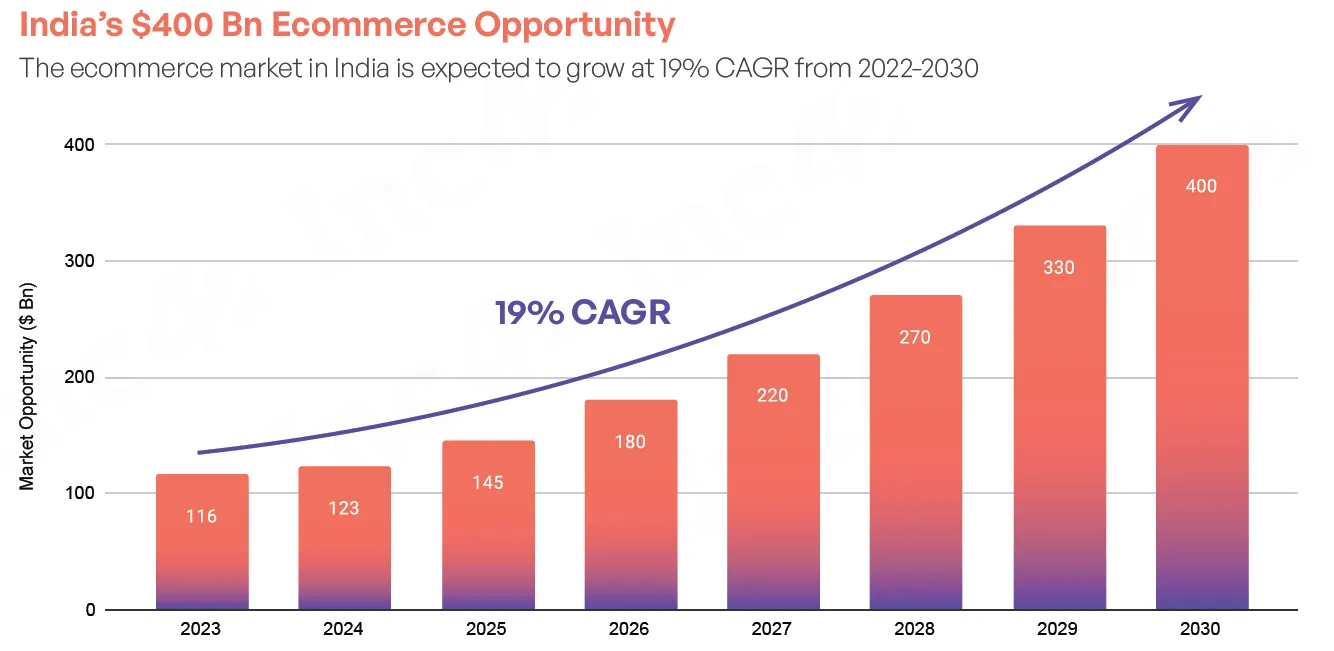

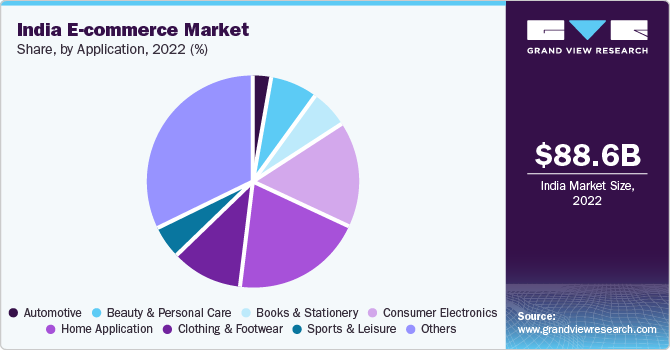

India has emerged as the second-largest e-commerce market globally by shopper base, surpassing even the United States. With the market projected to reach $170-$190 billion by 2030, growing at an impressive 18%+ annually, the stakes have never been higher. Bain & Company

Platform-by-Platform Analysis: The Titans Clash

1. Meesho: The Social Commerce Disruptor

Financial Performance 2024:

- Revenue Growth: $900M in 2024 (up from $689M in 2023)

- GMV Run Rate: $6.2 billion

- Market Share: 8.9% (up from low single digits four years ago)

- Order Growth: 34% year-on-year growth in 2024

- User Base: 175 million (25% growth)

- Daily Orders: 3+ million

Key Achievements:

- First horizontal e-commerce company to achieve positive cash flow in FY24

- Holds 60% of India’s social commerce market

- 97% reduction in adjusted losses to just ₹53 crore

Meesho has revolutionized social commerce by targeting India’s underserved Tier-2 and Tier-3 cities. With over 60% of entrepreneurs being women and a focus on vernacular languages, Meesho has tapped into previously unreachable markets. Business of Apps

2. Amazon India: The Global Giant’s Local Play

Market Position 2024:

- Global Revenue: $638 billion (11% YoY growth)

- India Market Share: Significant player with 47% smartphone market share online

- User Growth: 13% (slower compared to competitors)

- Quick Commerce Entry: Targeting Q1 2025 launch

Strengths:

- Strongest logistics network in India

- Premium customer base with higher spending power

- Technology leadership with advanced AI and ML capabilities

- Prime membership driving customer loyalty

Amazon continues to dominate in electronics and premium products, though it faces increasing competition in fashion and value segments.

3. Flipkart: The Homegrown Champion

Financial Performance FY24:

- Marketplace Revenue: ₹17,907 crore (21% YoY growth)

- Loss Reduction: 41% decrease to ₹2,358 crore

- Advertising Revenue: Nearly ₹5,000 crore (up from ₹3,325 crore)

- User Growth: 21% year-on-year

- Total Group Revenue: ₹70,542 crore (26.4% growth)

Strategic Initiatives:

- Quick Commerce: Launched “Minutes” service for rapid delivery

- Market Leadership: Continues to lead in overall e-commerce market share

- Advertising Business: Now surpasses marketplace fees as revenue source

Flipkart remains the market leader with strong performance across categories, particularly in smartphones and appliances. Economic Times

4. Myntra: The Fashion Powerhouse

Market Performance 2024:

- Profitability: Achieved profitability for the first time in FY24

- Fashion Market Share: 30-35% of India’s fashion e-commerce

- Revenue: Approximately $600 million annually

- Category Leadership: Dominates the fashion segment

Strategic Focus:

- Trend-first Commerce: Launching trendy collections at affordable prices

- Quick Fashion: M-now service for rapid fashion delivery

- Gen Z Targeting: Heavy focus on social media-savvy young consumers

Myntra has successfully positioned itself as India’s fashion destination, with strong brand partnerships and innovative marketing strategies.

The Fastest Growing Platform: Data-Driven Analysis

Based on comprehensive 2024 data, Meesho emerges as the fastest-growing e-commerce platform in India:

Growth Metrics Comparison:

| Platform | Revenue Growth | User Growth | Order Growth | Market Share Gain |

|---|---|---|---|---|

| Meesho | 30.6% | 25% | 34% | +3-4% points |

| Flipkart | 21% | 21% | ~20% | Stable |

| Amazon | ~13% | 13% | ~15% | Declining slightly |

| Myntra | ~15% | ~10% | ~12% | Stable in fashion |

Why Meesho is Winning the Growth Race

1. Untapped Market Penetration

- 60% of new customers come from Tier-3+ cities

- Focus on vernacular languages (Bengali, Tamil, Gujarati, Malayalam)

- Zero seller fees attracting small businesses

2. Social Commerce Innovation

- Integration with WhatsApp and Facebook

- Women entrepreneur focus (9 million female retailers)

- Community-driven sales model

3. Financial Discipline

- First to achieve positive cash flow among horizontal e-commerce players

- 97% reduction in losses while maintaining growth

- Efficient operational model

4. Strategic Positioning

- Hyper-value commerce model with ultra-low prices

- Quick commerce entry to compete with established players

- IPO readiness indicating strong fundamentals

Future Outlook: Market Trends Shaping 2025

Three Key Disruptions:

1. Quick Commerce Boom

- Growing at 40%+ annually

- Two-thirds of e-grocery orders now on quick commerce

- All major platforms launching rapid delivery services

2. Trend-First Commerce

- Fashion segment expected to quadruple to $8-10 billion by 2028

- Gen Z driving demand for trendy, affordable products

- Social media integration becoming crucial

3. Hyper-Value Commerce

- 12-15% of e-retail GMV from ultra-low price platforms

- Strong traction in Tier-2+ cities

- Zero commission models attracting sellers

Investment and Business Implications

For Businesses:

- Meesho offers the highest growth potential for value-conscious segments

- Amazon remains best for premium products and established brands

- Flipkart provides balanced reach across categories

- Myntra dominates fashion with strong brand partnerships

For Investors:

- Meesho’s IPO could be the biggest e-commerce listing in 2025

- Quick commerce presents significant investment opportunities

- Social commerce models showing sustainable profitability

Conclusion: The Growth Crown Goes to Meesho

While each platform has its strengths, Meesho stands out as the fastest-growing e-commerce platform in India for 2025. Its remarkable 34% order growth, 25% user base expansion, and achievement of positive cash flow while serving underserved markets makes it the clear winner in the growth race.

However, the Indian e-commerce market is large enough for multiple winners. Flipkart continues to lead in overall market share, Amazon dominates premium segments, and Myntra rules fashion. The key is understanding that each platform serves different market segments and growth strategies.

As India’s e-commerce market races toward $190 billion by 2030, the platform that best adapts to changing consumer preferences, emerging technologies, and evolving market dynamics will ultimately claim the crown. For now, Meesho’s social commerce revolution and rapid expansion into India’s heartland positions it as the growth champion of 2025.

Sources:

- Bain & Company: How India Shops Online 2025

- Business of Apps: Meesho Statistics

- Economic Times: Flipkart Performance

- Grand View Research: India E-commerce Market

For more such content visit: luxira.in