Your Complete Guide to Winning Investment Opportunities: AI Revolution, Green Energy Boom, and Emerging Market Trends

Market Analysis

AI Stocks

Renewable Energy

Semiconductors

Executive Summary

Market Outlook

Bullish

Expected S&P 500 Growth

8-12%

AI Market Size 2025

$184B

The 2025 stock market presents exceptional opportunities driven by artificial intelligence expansion, renewable energy transformation, and semiconductor innovation. With analysts expecting positive earnings growth and the potential for a “soft landing” economic scenario, investors are positioned to capitalize on emerging trends while navigating moderate volatility. Key sectors showing the strongest growth potential include AI technology, clean energy, and advanced semiconductors.

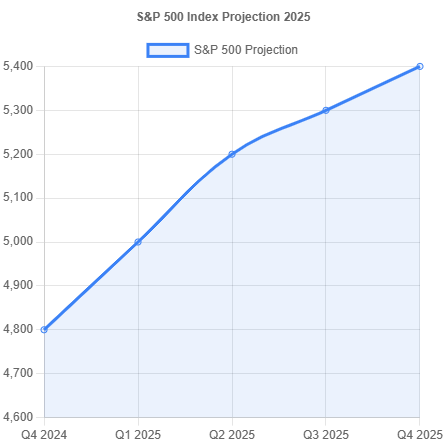

2025 Market Projections

Q1 2025 Outlook

Strong momentum expected with AI and tech leading gains. Market consolidation around 4,800-5,200 S&P 500 levels.

Mid-Year Forecast

Earnings growth acceleration in semiconductor and renewable energy sectors. Potential volatility from policy changes.

Q4 2025 Target

Year-end targets suggest 10-15% total returns with dividend reinvestment across diversified portfolios.

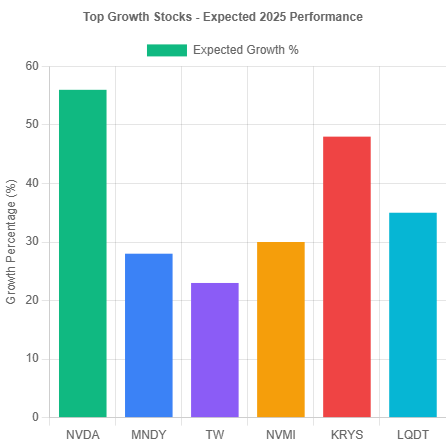

Top Growth Stocks for 2025

1

NVIDIA (NVDA)

AI Chip Leader

+56% Growth Expected

$135.50

2

Monday.com (MNDY)

Work Platform

+28% Growth Expected

$299.11

3

Tradeweb Markets (TW)

Financial Technology

+23% Growth Expected

$145.91

Nova (NVMI)

+41% Revenue Growth

Semiconductor equipment provider with strong positioning in AI chip manufacturing process.

$198.09+48% EPS Growth

Krystal Biotech (KRYS)

+247% Revenue Growth

Genetic therapy leader with FDA-approved treatments and strong pipeline expansion.

$126.45+104% EPS Growth

Liquidity Services (LQDT)

+35% Revenue Growth

B2B ecommerce platform with global reach and growing market share in asset liquidation.

$23.59+99% EPS Growth

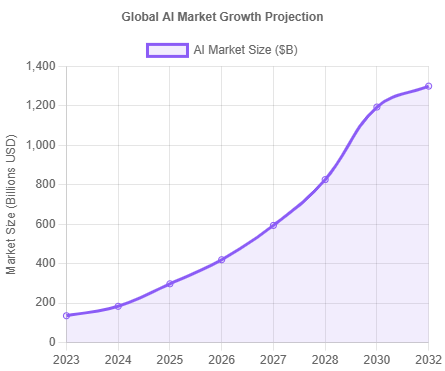

AI Technology Revolution

Market Size Projection

$1.3T

Expected AI market value by 2032

Annual Growth Rate

30%+

Compound annual growth through 2030

Top AI Investment Opportunities

NVIDIA Corporation

Dominant position in AI chips with 80%+ market share

Strong Buy

AMD

Advanced Micro Devices

Growing AI chip alternative with competitive pricing

Buy

MSFT

Microsoft Corporation

OpenAI partnership and Azure AI services growth

Buy

Investment Thesis

Data Center Boom

AI workloads driving unprecedented demand for specialized computing infrastructure

Enterprise Adoption

Companies increasingly integrating AI into core business operations

Software Innovation

New AI applications creating entirely new market categories

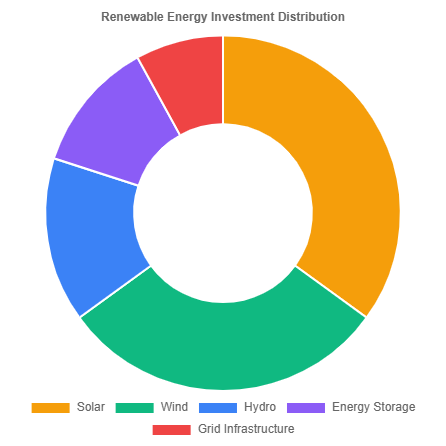

Renewable Energy Investment Opportunities

Key Investment Drivers

1

Government Support

Inflation Reduction Act providing billions in clean energy incentives

2

Cost Competitiveness

Solar and wind now cheaper than fossil fuels in most markets

3

Corporate Adoption

Fortune 500 companies committing to renewable energy targets

Market Outlook

Renewable energy sector expected to grow 12-15% annually through 2030, driven by technological improvements and policy support.

Top Renewable Energy Stocks

NextEra Energy (NEE)

Utility Leader

Largest renewable energy generator in North America with strong dividend history

Strong Buy3.0% Yield

First Solar (FSLR)

Solar Tech

Leading thin-film solar panel manufacturer with strong margins

BuyGrowth Play

Brookfield Renewable (BEP)

Global Portfolio

Diversified renewable energy assets across hydro, wind, and solar

Buy5.5% Yield

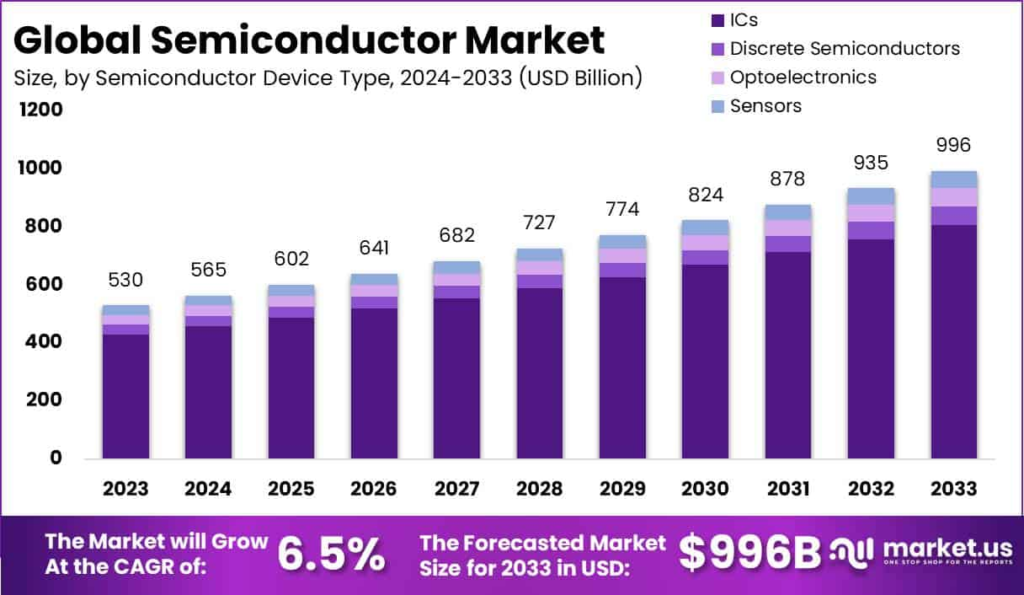

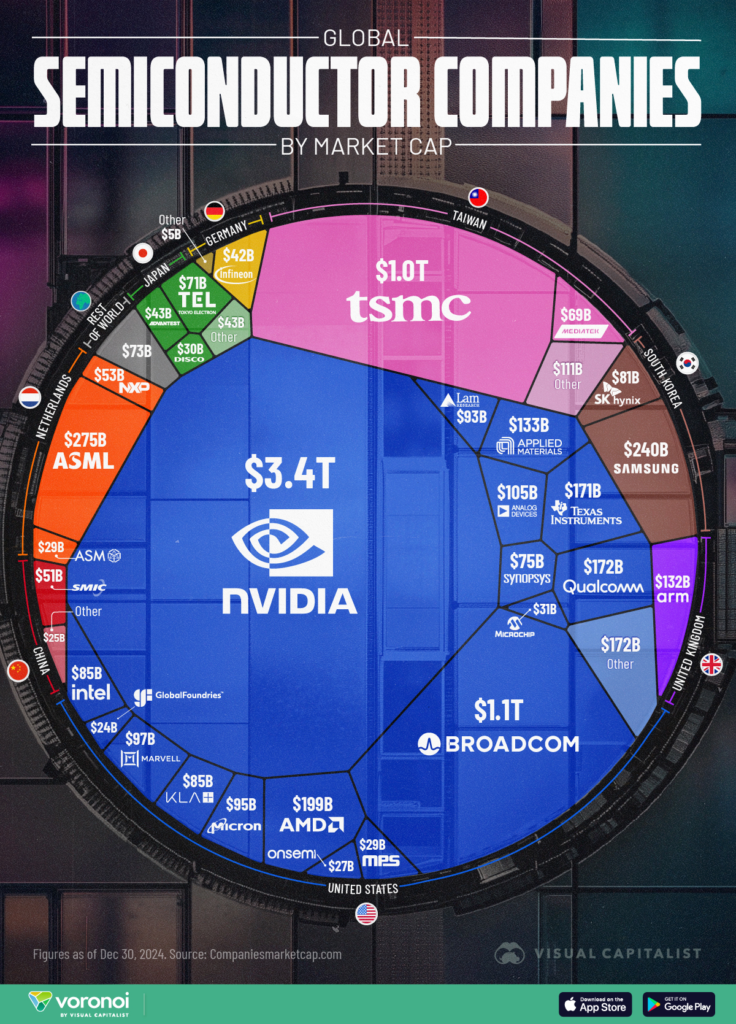

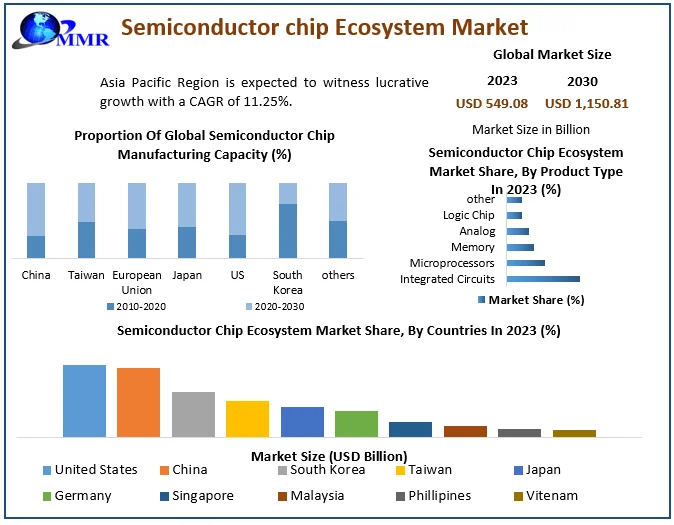

Semiconductor Industry Outlook

Market Growth Trajectory

2025 Semiconductor Projections

$697B

Global Sales

9.5%

Growth Rate

AI/Data Center Chips+45% Growth

Mobile Processors+6% Growth

Automotive Chips+15% Growth

Investment Strategy

Equipment Providers

Companies like ASML, Applied Materials benefiting from capacity expansion

Foundries

TSMC, Samsung leading advanced node production for AI chips

Designers

NVIDIA, AMD, Qualcomm creating next-generation chip architectures

Strategic Investment Approaches

Portfolio Allocation Recommendations

Investment Strategies by Risk Profile

Conservative Growth (Low Risk)

- • 40% Blue-chip tech stocks (MSFT, GOOGL)

- • 30% Dividend-paying utilities (NEE, SO)

- • 20% Broad market ETFs

- • 10% Bonds/Cash reserves

Balanced Growth (Medium Risk)

- • 35% AI/Tech growth stocks

- • 25% Renewable energy stocks

- • 25% Semiconductor leaders

- • 15% International diversification

Aggressive Growth (High Risk)

- • 50% High-growth AI stocks

- • 25% Emerging tech companies

- • 15% Biotech innovation

- • 10% Speculative plays

Risk Analysis & Mitigation

Key Risks to Monitor

Interest Rate Volatility

Federal Reserve policy changes could impact growth stock valuations

Geopolitical Tensions

Trade restrictions and supply chain disruptions affecting tech stocks

Valuation Concerns

High P/E ratios in growth sectors may face correction pressure

Risk Mitigation Strategies

Diversification

Spread investments across sectors, geographies, and market caps

Dollar-Cost Averaging

Regular investment schedule reduces timing risk

Fundamental Analysis

Focus on companies with strong balance sheets and sustainable advantages

Your 2025 Investment Action Plan

Q1 2025

- • Establish core positions in AI leaders

- • Begin renewable energy allocation

- • Monitor Federal Reserve policy

- • Review portfolio balance monthly

Mid-Year

- • Rebalance based on performance

- • Add semiconductor exposure

- • Assess earnings trends

- • Consider profit-taking opportunities

Q4 2025

- • Review annual performance

- • Tax-loss harvesting

- • Plan 2026 strategy

- • Celebrate your gains!

Ready to Capitalize on 2025 Opportunities?

The 2025 stock market presents a unique convergence of technological innovation, policy support for clean energy, and robust economic fundamentals. By focusing on AI technology leaders, renewable energy pioneers, and semiconductor innovators, investors can position themselves for significant returns while building a sustainable long-term portfolio.

Target Returns

10-15% annual returns with diversified growth strategy

Risk Management

Balanced approach with proper diversification

Growth Sectors

AI, renewable energy, and semiconductors leading the way

This analysis is for educational purposes only and should not be considered personalized investment advice. Always consult with a qualified financial advisor before making investment decisions.